INSURANCE COMPANIES HAVE EXPERTS WORKING FOR THEM. YOU SHOULD, TOO!™

Don’t Settle for Less - Most Trusted Large-Loss Hail Claim Public Adjusters

Hail Claim Experts.

Maximum Settlement in Minimum Time.

We help apartment owners, multifamily associations and property managers recover full and fair settlements after hail losses. Our licensed public adjusters work exclusively for you, never for the insurance company.

Don’t let delays and denials derail your recovery. Schedule your strategic claim review today and protect your asset.

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Don’t Settle for Less - Most Trusted Large-Loss Hail Claim Public Adjusters

Hail Claim Experts.

Maximum Settlement in Minimum Time.

We help apartment owners, multifamily associations and property managers recover full and fair settlements after hail losses. Our licensed public adjusters work exclusively for you, never for the insurance company.

Don’t let delays and denials derail your recovery. Schedule your strategic claim review today and protect your asset.

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Fast, Free, No-Obligation Inspections. We’ll Be in Touch Within 24 Hours!

20+

Years Experience

500+

Large-Loss Claims Settled

$250M+

Settled Property Insurance Claims

Hail Claim Experts

Hail damage to apartment complexes creates unique challenges — multiple tenants, roof and window impacts, water intrusion, and costly business interruptions. ICRS specializes in managing these complex claims. We protect your investment, advocate for your rights, and ensure you're not left covering losses out of pocket.

🔥 Apartment & Multifamily Hail Damage Claim Experts

We help owners, HOAs, and property managers recover from hail damage affecting one or multiple buildings. Our team coordinates roof and exterior inspections, water-intrusion mitigation, loss-of-rent calculations, and detailed damage assessments to ensure nothing is overlooked.

🔥 Commercial Building

Hail Damage Claim

If hail damage has displaced tenants or disrupted operations, you may be entitled to compensation for lost rental income. We manage business interruption claims from start to finish to help you recover every dollar you’re owed.

🔥 Luxury Home Hail Damage Claim Specialists

We understand the pressures management companies face after a hailstorm — leaking roofs, damaged windows, upset tenants, and unclear insurance answers. Let us take over the claim process so you can stay focused on your residents and daily operations.

Hail Damage Claim Results For Policyholders

Are You

Struggling With...

Are You Struggling With...

Initial Hail Claims

When hail damages your

commercial building, apartment complex, or luxury home, filing your insurance claim correctly from the beginning is critical.

Large-loss hail claims involve significant property damage and high-dollar settlements. As trusted public adjusters, we make sure your initial claim is accurately documented, aggressively represented, and positioned for full compensation..

Underpaid Hail Claims

Insurance companies often lowball hail claim payouts especially on large-loss properties. If your settlement doesn’t match the real scope of damage, you could be leaving thousands on the table.

At ICRS our experts identify missed damage, undervalued estimates, and hidden policy coverage gaps. We reopen, negotiate, and supplement

underpaid claims to recover what you’re truly owed.

Denied Hail Claims

Denied hail claim? You’re not alone. Insurers often cite

policy exclusions, pre-existing damage, or missing documentation

to avoid paying.

Our public adjusters specialize in overturning wrongfully denied hail claims - correcting inspection errors, providing new documentation, and demanding fair treatment.

Why Choose ICRS Public Adjusters ?

No Recovery, No Fee Representation*

We don’t get paid unless you do.

Proven Results

Hundreds of millions in commercial and multifamily claims recovered.

Expert Representation

500+ large-loss claims settled fairly & promptly.

Avoid Unnecessary Litigation

We negotiate maximum settlements without jumping straight to court.

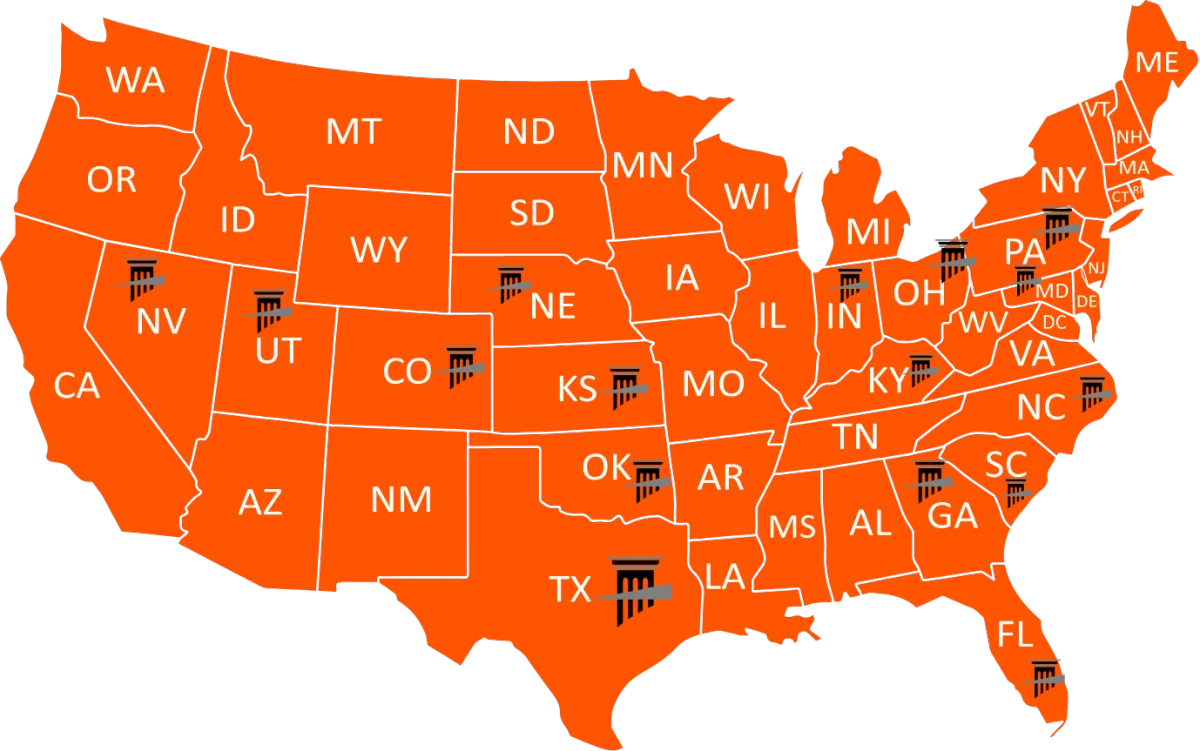

Licensed Nationwide

Serving policyholders in 16 states.

Verifiable Increases

We’ve boosted settlements by 20% to over 3,800% compared to initial insurance offers.

The Nations Leading Hail Damage Claim Specialists

Hail Damage Claim Denied or Underpaid?

If your hail damage claim has been delayed, denied, or lowballed, it’s time to take action. Insurance carriers often dispute hail damage claims - but we have the expertise to prove the real extent of your losses.

Storm and wind damage

Schedule a Strategic Claim Consult Today

The Nations Leading Hail Damage Claim Specialists

Hail Damage Claim Denied or Underpaid?

If your hail damage claim has been delayed, denied, or lowballed, it’s time to take action. Insurance carriers often dispute hail damage claims - but we have the expertise to prove the real extent of your losses.

Storm and wind damage

Schedule a Strategic Claim Consult Today

Licensed Public Adjusters In 16 States:

Certified Commercial Roof Inspector

Trusted Hail Storm Insurance Claim Experts

HAAG-Certified & Ready to Help

Navigating a large hail damage claim? Our HAAG-certified adjusters specialize in identifying storm-related losses insurers often overlook. We ensure Texas business owners get the full value of their policies—no excuses, no delays.

Industry-Leading Experts in Commercial Roof Claims

We Challenge Underpaid & Denied Claims

Detailed Roof Inspections That Stand Up to Insurance Scrutiny

Certified Commercial Roof Inspector

Trusted Hail Storm Insurance Claim Experts

HAAG-Certified & Ready to Help

Navigating a large hail damage claim? Our HAAG-certified adjusters specialize in identifying storm-related losses insurers often overlook. We ensure Texas business owners get the full value of their policies—no excuses, no delays.

Industry-Leading Experts in Commercial Roof Claims

We Challenge Underpaid & Denied Claims

Detailed Roof Inspections That Stand Up to Insurance Scrutiny

EXECUTIVE PUBLIC ADJUSTERS

Meet Our Public Adjusters

Meet Our

Public Adjusters

Scott Friedson

CEO | Public Insurance Adjuster

Scott formed Insurance Claim Recovery Support LLC aka ICRS, to help policyholders needing strategic and practical representation recovering from property damage insurance claims. Policyholders dealing with complex large-loss insurance claims can face many issues ranging from delays, underpayments, omissions, misrepresentations, or wrongful denials.

Commercial and Multifamily owners, property management companies and homeowner associations have received the results and benefits they deserve with Scott’s expertise while avoiding unnecessary litigation and appraisals.

As an active member in the multifamily, contractor, and public adjusting community, he has been a speaker at the apartment, storm restoration, general, and roofing contractor associations advocating what policyholders and management companies need to know about insurance claims. Scott holds public insurance adjuster licenses in Texas, Florida, Colorado, Georgia, Indiana, Kansas, Kentucky, Nebraska, South Carolina, North Carolina, Maryland, Ohio, Pennsylvania, Utah, Nevada, and Oklahoma.

He is also a Haag Certified Commercial Roof Inspector, Certified Appraiser & Umpire – CPAU, IICRC – Certified Water Restoration Tech with millions in successfully negotiated hail, fire, hurricane, tornado, flood, lightning, storm, business interruption, and other insurance claim settlements on behalf of his policyholder clients. Friedson retired as a Texas apartment real estate broker when he formed ICRS and has more than 30 years of combined experience in real estate as a broker, lender, apartment investor, and public insurance adjuster.

Misty Friedson

VP | Public Insurance Adjuster

With four years of dedicated experience as a licensed Public Insurance Adjuster, Misty brings a proven track record of successful claim resolution and unwavering advocacy for policyholders. Specializing in large-loss property damage claims, she has cultivated deep expertise in representing a diverse clientele that includes religious organizations, multifamily apartment owners, educational institutions, hotels, and homeowner associations (HOAs).

In addition to being a licensed public adjuster, Misty is a Haag Certified Commercial Roof Inspector known for her meticulous claim documentation, strategic negotiation skills, and steadfast commitment to maximizing fair settlements under the terms of the insurance policy. Her approach ensures that each client receives personalized service tailored to the unique complexities of their property and claim.

Having worked closely with faith-based institutions, historical buildings, and nonprofit organizations, Misty is particularly adept at navigating the nuances of policies covering sanctuaries, community centers, and auxiliary buildings. Her experience with multifamily and hospitality property owners has helped recover millions in damages from perils such as hail, fire, windstorms, and water intrusion—minimizing claim cycle times and avoiding unnecessary litigation.

As part of the ICRS team, Misty upholds the firm’s core philosophy of being exclusively policyholder advocates, offering clients she represents a no recovery, no fee promise and delivering results that consistently exceed expectations. Her work contributes to the firm’s reputation for resolving over 90% of claims without unnecessary appraisal or litigation, a testament to her negotiation acumen and deep knowledge of insurance claim process.

Our Core Values

We Pursue the Truth

We Do What's Best for the Insured

We Win For Policyholders

We Act in Good Faith

We are Reasonable

We are Trusted and Respected

We don't take NO for an answer

Zero tolerance for B.S.

TESTIMONIALS

Hear what Our Clients are saying

"Thank you Scott"

Scott responded to my inquiry and took the time to listen and understand our unpleasant experience dealing with our insurance claim. Although I did not utilized his service, he gave me a sound, professional advice and offered to help when he referred me to his engineer. They replied promptly and I was able to have better understanding of the situation. Thank you Scott!

Haidee J.

Client

"I would highly reccomend"

Words can’t describe how grateful we are for the consultation and claim evaluation we had with Scott. Full disclosure we were unable to work with him due to limitations of our scope. We wanted to properly recognize Scott for the honest and genuine passion he put in to not only our claim, but the way he runs his business in general. We hadn’t had such clarity of next steps since this began in 2020. I would highly recommend this business to everyone spinning their wheels in this process!

James M.

Client

"I felt I could fully trust him..."

This was not the first public adjuster I called. I called a different company first but they gave me a bad feeling on the phone. Too aggressive. Didn't feel trustworthy to me. So, I kept looking. I came across this company and I had none of those bad feelings. Scott, the guy who took my call, seemed very knowledgeable and I felt I could fully trust him. As it turned out, he told me that my claim was fairly simple and I didn't need the full scope of his service and fees. But, without charging me a fee, he gave me some needed advice on this whole matter of insurance claims which I needed. And told me I could call him back to ask another question or two if necessary. I would recommend this company for these services.

Katie H.

Client

"Scott negotiated to maximize our claim."

I definitely recommend ICRS! Scott and Misty went above and beyond to advocate on our behalf and help us navigate the nightmare of a large loss insurance claim. Scott has worked as a public adjuster for more than 15 years. He was extremely knowledgeable about the process, laws, and holding the insurance company accountable. The initial amount the insurance company agreed to would not have been enough to restore our property, and Scott negotiated to maximize our claim.

Julie Bug

Client

"They are truly a lifesaver!"

I cannot say enough good things about Insurance Claim Recovery Support — they truly feel like earth angels. Misty and Scott helped me through one of the most overwhelming and helpless times of my life. As a single woman dealing with major home renovations after a severe water leak, I was unfortunately taken advantage of by a dishonest contractor. From breaking my TV and not saying a word, to lying about repairs, damaging my sprinkler, inflating estimates with bogus charges, and even threatening legal action — I was completely overwhelmed.

That’s when Misty and Scott stepped in. Their knowledge of the laws and the insurance claims process is unmatched, and their compassion and support were exactly what I needed. They knew exactly how to handle the situation, empowered me with the facts, and guided me every step of the way. They genuinely listened, made me feel heard and understood, and stood by my side when I needed it most. I am beyond grateful for their integrity, expertise, and kindness. If you’re facing a tough insurance claim situation, do not hesitate to reach out to them — they are absolute professionals and true advocates and helped me feel safe in my own home again.

Katie H.

Client

ATTENTION: TARGET AUDIENCE

How To Desire Without Doing Z To Achieve Goal

Download the free report and take your marketing to the next level

not sure if you need help with your hail claim?

Frequently Asked Questions

What should I do immediately after a large-loss Hail Claim?

If your commercial or multi-family property in has suffered hail damage, taking the right steps immediately can protect your claim and maximize your settlement.

Understand Your Policy Obligations

Your insurance policy outlines specific duties you must fulfill after a hail loss, including documenting damage, preventing further loss, and filing your claim promptly.

Act Quickly to Minimize Risk & Liability

Delays in addressing damage can lead to increased repair costs and insurance disputes. Moisture intrusion, structural weakening, and further exposure can jeopardize your claim.

Don’t Let the Insurance Company Dictate Your Settlement

Insurance carriers may undervalue, delay, or deny hail claims. If you're not getting the answers you need, seek professional claim assistance to ensure you receive the full payout you’re owed.

Get Expert Help Now

Our hail claim specialists help policyholders navigate complex insurance policies and recover maximum compensation. Schedule Your Free Claim Review Today.

What qualifies as a "large-loss" storm claim?

A large-loss storm claim typically refers to insurance claims exceeding $250,000 in property damage, often involving commercial buildings, multi-family properties, and high-value assets affected by severe weather events such as hailstorms, hurricanes, and tornadoes.

Key Factors That Define a Large-Loss Claim:

Significant Structural Damage – Roof destruction, window breakage, water intrusion, and facade impact.

Widespread Property Loss – Multiple buildings, large commercial facilities, or apartment complexes.

Extensive Business Interruption – Loss of revenue due to operational shutdowns caused by storm damage.

Complex Claim Negotiations – Insurers often dispute the full extent of large-loss claims, requiring expert representation.

Why Acting Fast Matters

Understanding your contractual obligations as a policyholder and the responsibilities your insurance provider owes you is crucial to avoiding unnecessary liability and risk. If your insurance company is delaying or undervaluing your claim, don’t wait. The longer damage remains unaddressed, the greater the risk of moisture intrusion, structural weakening, and increased liability.

Need Expert Help? Our large-loss claim specialists ensure you recover the full compensation you deserve. Schedule a Free Claim Review Today.

What if my hail damage claim was underpaid?

If your insurance company didn’t pay enough to cover the full extent of your hail damage repairs, you’re not alone. Insurance carriers often undervalue claims, misclassify damage, or use loopholes to reduce payouts. However, you have options to fight for the compensation you deserve.

Why Do Insurance Companies Underpay Hail Damage Claims?

Lowball Estimates – Insurers often undervalue repair costs, leaving property owners paying out of pocket.

Improper Damage Assessments – Adjusters may overlook structural issues or claim damage is "cosmetic" to reduce payouts.

Depreciation & Policy Exclusions – Some policies factor in wear and tear to justify lower settlements.

How to Fight Back & Recover What You’re Owed

Get an Independent Claim Review – A second opinion from an expert public adjuster or claims specialist can uncover missed damages and undervalued repairs.

Demand a Reassessment – You have the right to challenge your insurance company’s payout if it doesn’t align with policy coverage.

Work with Hail Claim Experts – Professionals who specialize in large-loss hail claims can negotiate for a higher settlement and ensure you’re fully compensated.

Don’t Let the Insurance Company Shortchange You

Understanding your policyholder rights is key to protecting your property and financial investment. If your insurer isn’t paying what they owe, take action now. The longer you wait, the harder it becomes to dispute the claim.

Need Help? Our team of hail damage claim specialists has helped policyholders recover millions. Get a Claim Review Today.

Can I dispute my hail damage claim payout?

Yes, if you believe your insurance company has undervalued, delayed, or denied your hail damage claim, you have the right to dispute the payout. Many policyholders face lowball settlements, overlooked damage, or improper claim denials, but there are steps you can take to fight for the compensation you deserve.

When Should You Dispute a Hail Damage Claim?

The insurance company did not account for all damages to your roof, windows, or exterior.

Your payout is significantly lower than contractor estimates for necessary repairs.

The insurer claims pre-existing damage or uses policy loopholes to reduce the settlement.

The claim process has been delayed or denied without a clear explanation.

How to Dispute an Underpaid or Denied Hail Damage Claim

1. Review Your Policy – Check your policy to understand your coverage limits, deductibles, and exclusions.

2. Get a Second Opinion – A licensed public adjuster or independent roofing expert can assess whether your damages were fully accounted for.

3. Request a Reassessment – You can formally dispute the insurer’s estimate by providing additional documentation and requesting a second inspection.

4. File an Appraisal or Appeal – Many policies allow for an appraisal process, where a neutral third party helps settle claim disputes.

5. Seek Professional Assistance – If your claim is still undervalued, a claims advocate or legal expert can negotiate on your behalf.

Take Action Before It’s Too Late

Insurance companies may set deadlines for disputing claims, so it’s important to act quickly. If your hail damage claim was underpaid, do not settle for less than you are owed. Our team of hail claim specialists has helped policyholders recover full payouts.

Request a Free Claim Review Today.

Do I need a Public Adjuster if I have already received my settlement?

Yes, even if you have already received a settlement, a public adjuster can help determine if you were underpaid and whether you are entitled to additional compensation. Insurance companies often undervalue claims by overlooking damages, applying depreciation, or using restrictive policy interpretations. If your settlement does not fully cover the cost of repairs, you still have options.

Why Hire a Public Adjuster After Receiving a Settlement?

Settlement Review – A public adjuster can analyze your claim to ensure the insurance company accounted for all damages and provided a fair payout.

Supplemental Claims – If additional damage is found or your initial payout was insufficient, a public adjuster can negotiate for a higher settlement.

Reopening a Claim – Many policies allow claims to be reopened within a certain time frame, especially if new damages become evident.

Independent Damage Assessment – Insurance adjusters work for the insurance company, while a public adjuster represents your best interests.

When Should You Consider a Public Adjuster?

Your settlement does not fully cover repair costs.

You suspect the insurance company undervalued or missed damage.

You were told certain damage is not covered, but you are unsure if that is accurate.

You want an expert to handle negotiations and maximize your recovery.

Its best to act quickly with the best support by your side

Insurance policies often have strict deadlines for filing supplemental claims or reopening a claim. If you believe your hail damage settlement was too low, consulting a public adjuster could help you recover the full amount you are owed.

Get a Free Settlement Review Today.

TRUSTED PROFESSIONALS

Our Licences & Specialties

Agency Public Adjuster Licenses

Texas #1670060

Colorado #4472448

Ohio #1416560

Florida #W927993

NPN# 16144334

Misty's Public Adjuster Licenses

Texas #2647568

Florida #W798577

Kentucky #1267289

North Carolina #19846653

Nebraska #19846653

Ohio #1416569

Oklahoma #3001820951

Pennsylvania #1054792

South Carolina #19846653

Utah #915489

NPN #19846653

Haag Certified Commercial Roof Inspector #202111207

Scott's Public Adjuster Licenses

Texas - #1632488

Colorado #411678

Florida #W797805

Georgia #2874635

Indiana #3891955

Kansas #15827727

Kentucky #1014264

Maryland #2106190

North Carolina #15827727

Nebraska #15827727

Nevada #3508775

Ohio #1289475

Oklahoma #100118599

Pennsylvania #1043874

South Carolina #893766

Utah #915234

NPN #15827727

Haag Certified Commercial Roof Inspector #201408103

IICRC WRT Certified #229373

Our Large Loss Specialties

Apartment Complexes

Business Interruption

Commercial Buildings

Condominium Associations

Homeowner Associations

Homes

Historical Buildings

Industrial and Manufacturing Facilities

Office Buildings

Property Management Companies

Religious Organizations

Retail Centers

Schools

Storage and Warehouse

Fire

Flood

Hail

Hurricane

Lightning

Tornado

Water

Wind

Appraisal